The Inspectorate found significant variation in council reporting on councillor expenses in annual reports, due in part to different interpretations of the five expenses categories in the 2014 Regulations.

The Local Government Better Practice Guide for the Report of Operations 2019-20 provides an example of how expenses are to be reported in the annual report.24 Despite this, there is still variation in how expenses are reported on in annual reports.

A key area of variation is the categories of expenses. This can be attributed to the fact that there is no guidance on what the five expenses categories in the 2014 Regulations mean, leaving it open to interpretation between councils. There are also expenses legitimately incurred by councillors that do not clearly fit into the five categories such as stationery, costs associated with attendance at functions and events, and office equipment other than ICT. A review of council annual reports shows that councils are using categories additional to the five in the 2014 Regulations. The audit revealed the most common additional category reported on in annual reports is ‘other’, which may or may not be defined in the annual report. This is followed by items such as ‘courier costs for agenda papers’, ‘equipment’, ‘materials’, ‘meals and networking’ and ‘functions’.

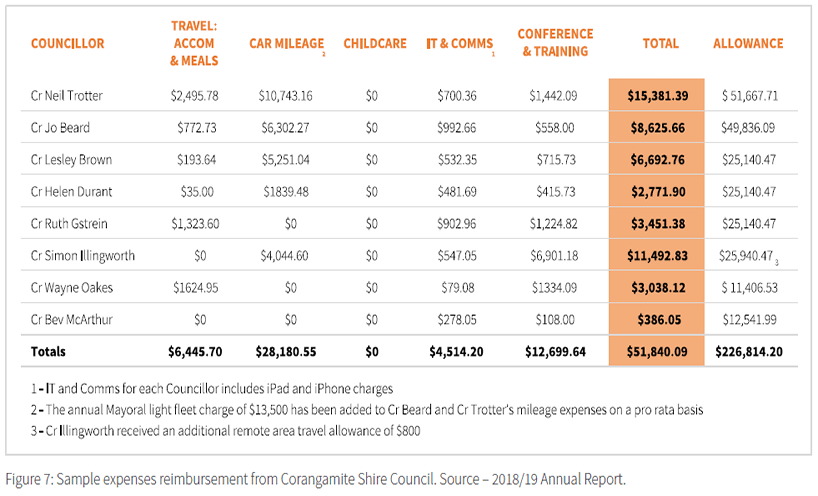

There is also an absence of guidance on how expenses are to be apportioned across the expense categories. An example is ‘conferences and training’. Some councils include all associated costs with a conference in this category, like travel to/from and meals, whereas other councils may report on the travel and meals separately. An example of transparent reporting of expense reimbursement claims, printed in Corangamite Shire Council’s 2018/19 annual report (figure 7) includes separate figures for travel and accommodation, car mileage, and conferences and training, so readers are clear on accurate costs of those categories.

From reviewing council approaches to the publication of expenses data in their annual reports for FY18-19, methods for improving transparency include:

- reporting on councillor expenses and allowances separately;

- reporting on the five expenses categories in the 2014 Regulations separately, not in a combined manner (for example, not combining travel with car mileage);

- reporting subtotals of expenses for each councillor and each expense category (in addition to reporting on the overall total councillor expenses);

- providing explanations/definitions of any additional categories used, such as ‘other’, ‘unspecified’ or ‘miscellaneous’ expenses categories.

While it is not a legislative requirement, including expenses data on a council website can improve transparency and integrity of expenses. An Inspectorate review of council websites in early 2020 showed that less than half of councils are publishing expenses data on their websites and less than a fifth are doing this with regularity.25 However, there are Victorian councils that do report expenses regularly, such as Melbourne City Council, which publishes data on councillor expenses on a quarterly basis on their website.26

24. Local Government Better Practice Guide Report of Operations 2019-20, page 61

25. Based on Inspectorate’s review of 79 council websites, January 2020

26. Available on the City of Melbourne website