- Date:

- 15 Sep 2020

Councillor expenses and claims for reimbursement often attract public attention. Because councils are publicly funded, their systems for managing expenditure are subject to particular scrutiny. The integrity and transparency of those systems are critical for maintaining public confidence in the important work of local government.

Councillor expenses have been the subject of numerous Local Government Inspectorate investigations. These have identified many instances of councillors making false, or inadequately supported, claims for expense reimbursement. It is important for the local government sector to work continuously to improve the transparency of processes surrounding expense reimbursement and to create greater accountability for councillors making expenses claims.

Our review of councillor support involved two main aspects: surveys of councillors and governance staff on the level of support councillors receive, and an audit of several councils to assess compliance with legislation and identify best practice for the benefit of the whole sector. There was an encouraging level of engagement from councils in both aspects of the review, with more than 90% of governance staff providing information and more than 40% of contacted councillors responding to our surveys.

The Local Government Act 2020 contains limited direct guidance as to the kind of resources and facilities which should be made available to support councillors, and in defining the types of expenses which may be considered appropriate. This places a particular onus on councils

to ensure that expenses policies, which provide for the reimbursement of out-of-pocket expenses, meet community expectations.

This review is timely: we have new local government legislation and new opportunities for the State Government and the sector to develop materials to assist councils with navigating the new legislative environment. This review carefully considers a range of issues associated with councillor expenses and provides guidance and insight into the development and application of expenses policies.

Dr John Lynch

Acting Chief Municipal Inspector

Scope of the examination

Scope of the Local Government Inspectorate's examination into councillor expenses and allowances.

The Inspectorate is the dedicated integrity agency for local government in Victoria. The Chief Municipal Inspector has powers as set out in the Local Government Act 2020 (Act) to enable the Inspectorate to examine, investigate and prosecute any matter relating to a Council’s operations and any breaches of the Act.

An Inspectorate project reviewing support provided to elected councillors has built a picture of the varied approaches to councillor resources and expense

reimbursement procedures across the state. The project assessed what support is provided to councillors, levels of satisfaction with this support and what improvements could be made in relation to support/resources.

The project also examined what kinds of expenses are being claimed and how expenses policies are working in practice with a view to recommending improvements to the expenses process to better meet community expectations.

Section 39 of the Act, which came into operation on 6 April 2020, provides the framework for the payment of an allowance to councillors and mayors. Section 40 governs the reimbursement of councillor expenses and section 41 requires the adoption and maintenance of a Council Expenses Policy. Sections 40 and 41 commenced on 1 May 2020.

In tandem with the new Act, Local Government Victoria (LGV) published in June 2020 a draft Council Expenses Policy to support councils in their requirement to adopt an expenses policy compliant with the new Act by 1 September 2020.1

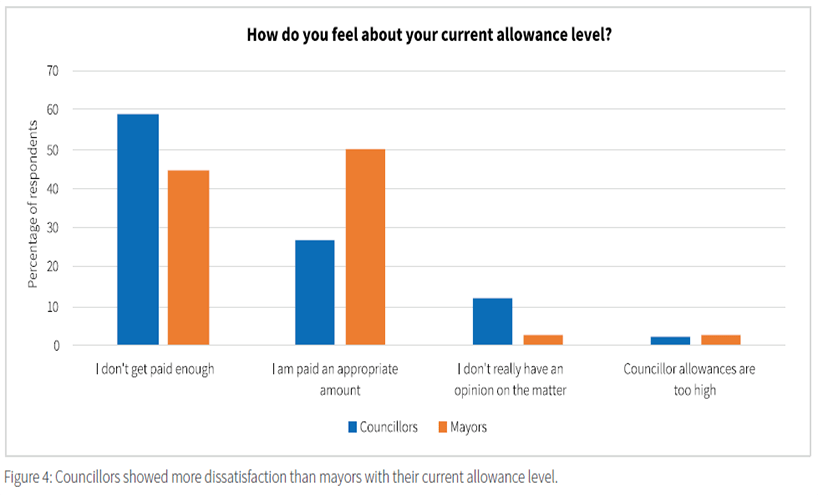

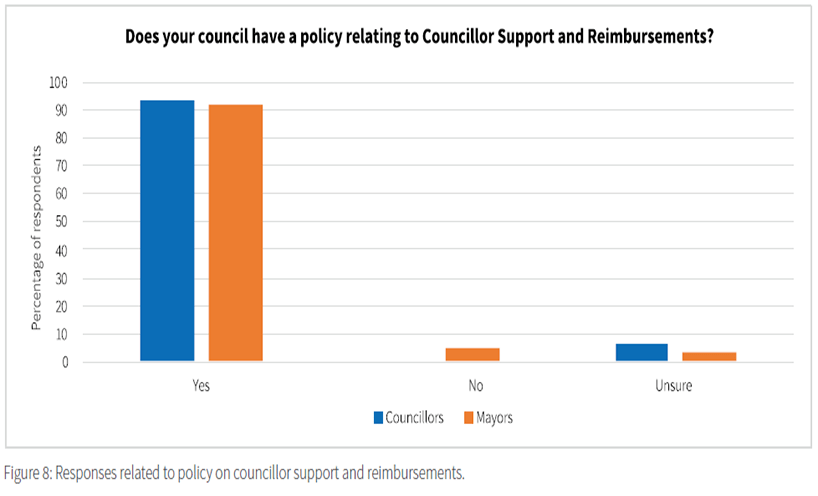

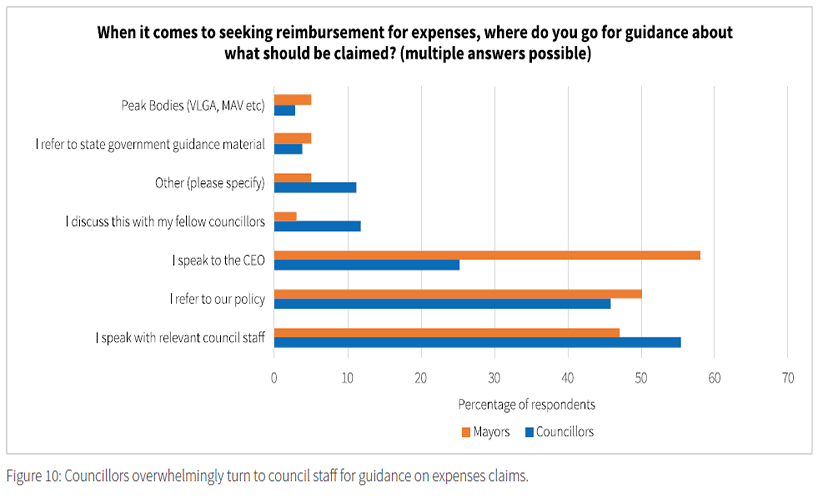

After two surveys of council governance staff and councillors, the data identified patterns with the management of expenses and allowances, variations between mayors and councillors, and other areas of interest.

The Inspectorate encountered some difficulties in comparing and aggregating the data from the first councillor support survey. This was mainly due to differences between councils in their interpretation of the expense categories and their approaches to reporting on expenses.

Overview of councillor support and expenses policy

Overview of councillor support and expenses policies by the Local Government Inspectorate.

Sections 39 to 42 of the Act provide the framework for councillor support and entitlements, which includes, but is not limited to:

- an optional allowance 2

- a toolkit of resources such as a mobile phone, computer, stationery, taxi vouchers, and council office space 3

- reimbursement of out-of-pocket expenses incurred in the course of their role, such as information technology costs, meals, travel, training, and childcare 4

Councillors have the discretion to elect to receive the entire allowance to which they are entitled, part of the allowance, or no allowance.5 The allowance is currently set by the Minister for Local Government,6 with councils divided into three categories based on their income and population.7 Each of the three categories has a lower and upper range of allowance for councillors and an upper range for the mayoral allowance. The exception is Melbourne City Council, whose allowances are separately fixed.8 Previously, the allowances for Geelong City Council were also separately determined under section 13(3) of the City of Greater Geelong Act 1993 (repealed on 6 April 2020). Under the Act, the allowance will now be determined by the Victorian Independent Remuneration Tribunal.9

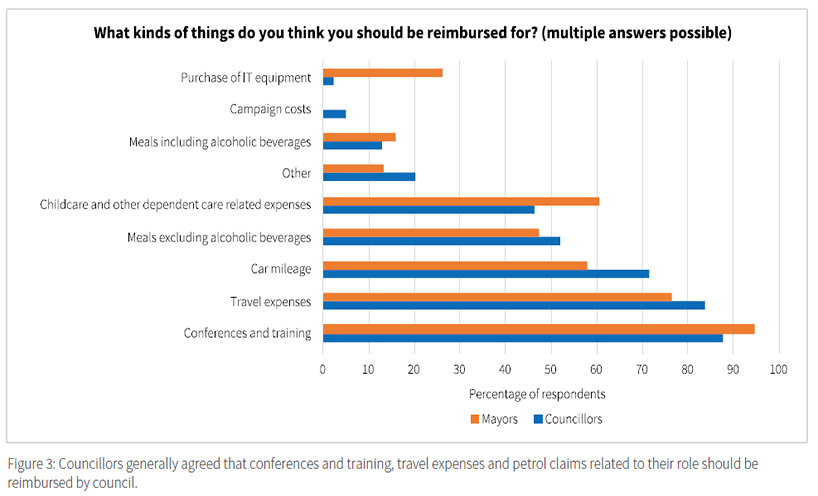

Councils are only required to reimburse councillors for out-of-pocket expenses which are bona fide, have been reasonably incurred in performing their role, and are reasonably necessary for the performance of their role.10 The Act does not specify the kinds of expenses which meet these criteria, other than requiring that councillors be reimbursed for child care costs and carer’s costs where they are reasonably required for the councillor to perform their role.

The Local Government (Planning and Reporting) Regulations 2014 (the 2014 Regulations) provide some further insight into the kinds of expense categories that are readily recognised as reimbursable, being travel expenses, car mileage, information and communication technology expenses, and conference and training expenses.11 Otherwise, councils have scope to establish the criteria for reimbursable out-of-pocket expenses, together with the procedures by which they will be reimbursed, in their Council Expenses Policy.

The Act requires that councils must make available to councillors the resources and facilities reasonably necessary to enable them to effectively perform their role.12 The Act is not prescriptive in terms of what kinds of resources and facilities must be provided. Again, councils have the flexibility to address what resources and facilities will be provided, together with guidance on their correct usage, in their internal policies.

At the time of the survey and council audits, the majority of councils addressed councillor allowances, resources and facilities together with expense reimbursement in their Councillor Reimbursement Policy.13 Under the Act, every council was required to adopt a Council Expenses Policy to govern the procedures to be followed in reimbursing out-of- pocket expenses by 1 September 2020.14

To be compliant with the new Act, a council’s expenses policy must:

- apply to both councillors and members of delegated committees;

- comply with any requirements prescribed by the regulations in relation to the reimbursement of expenses;

- include reimbursement of childcare costs; and

- provide for reimbursement of expenses incurred by councillors who are carers in a care relationship within the meaning of section 4 of the Carers Recognition Act 2012.15

Up until the new policy is adopted, the existing Councillor Reimbursement Policy continues to operate.16

Footnotes

2. Section 39 of the Local Government Act 2020

3. Section 42 of the Local Government Act 2020

4. Sections 40 and 41 of the Local Government Act 2020

5. Section 74A of the Local Government Act 1989 (repealed) and section 39(5) of the Local Government Act 2020

6. Sections 73A and 73B of the Local Government Act 1989 (repealed); section 39(6) of the Local Government Act 2020

7. Victoria Government Gazette, No. S 564 Monday 23 December 2019

8. Section 26A(3) of the City of Melbourne Act 2001 (repealed), section 13(3) of the City of Greater Geelong Act 1993 (repealed). See Victoria Government Gazette, No. S 459 Wednesday 13 November 2019

9. Section 39 of the Local Government Act 2020

10. Section 40(1) of the Local Government Act 2020

11. Section 14(2)(db) of the Local Government (Planning and Reporting) Regulations 2014

12. Section 42 of the Local Government Act 2020

13. Section 75B of the Local Government Act 1989 (repealed); section 39(6) of the Local Government Act 2020

14. Section 41(3) of the Local Government Act 2020

15. Section 41(2) of the Local Government Act 2020

16. Section 41(4) of the Local Government Act 2020

Methods and key findings from the review

Methods and key findings from the LGI review into councillor expenses and allowances.

This review of councillor support involved separate surveys of councillors and governance staff on the support councillors receive, and an audit of seven randomly-selected councils to assess legislative compliance and identify best practice in policies and procedures.

Allowance and toolkit

Review of the councillor toolkit and allowance.

Overview

The Local Government (Councillor Remuneration Review) Panel conducted a review and provided recommendations in 2008 regarding councillor allowances, reimbursement of expenses, and provision of resources and facilities to support mayors and councillors.

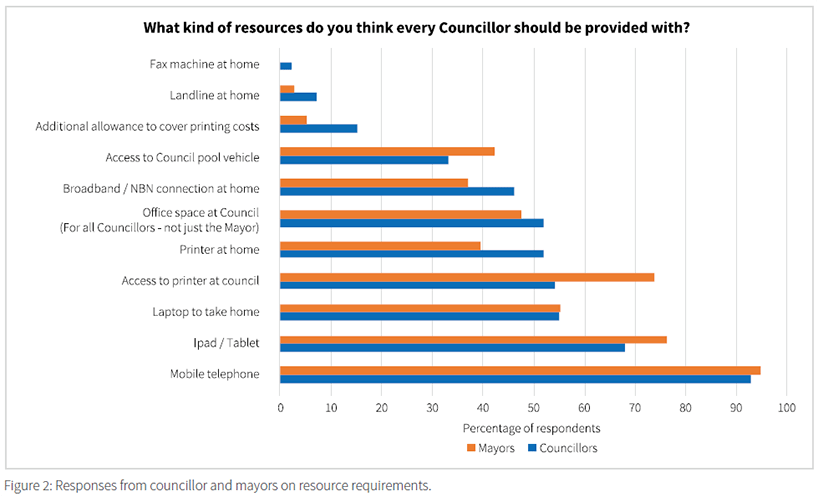

This culminated in a new policy published in April 2008 – ‘Recognition and Support: the Victorian Government’s Policy Statement of Local Government Mayoral and Councillor Allowances and Resources’, which included a recommended minimum ‘toolkit’ of resources and facilities for councillors.

As comprehensive guidance regarding councillor support was last issued in 2008, the Inspectorate sought to ascertain whether councillors are being adequately supported by way of the ‘toolkit’ of resources and facilities made available to them.

Councillor expenses

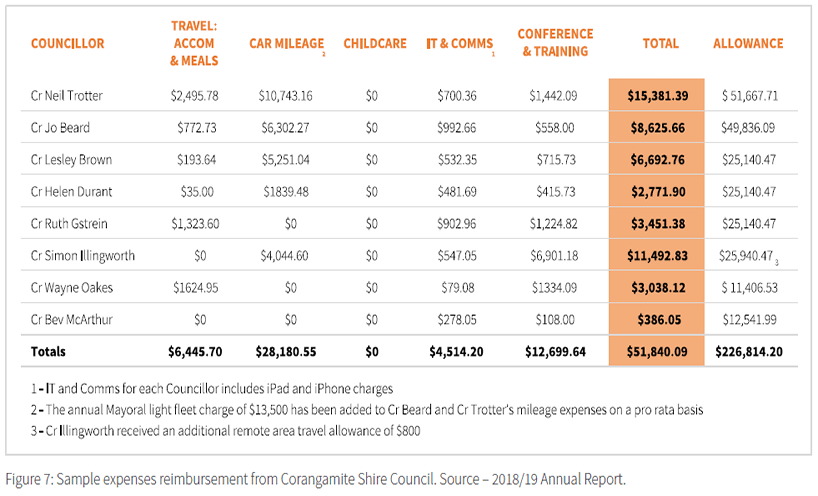

Councils are expected to annually report on councillor expenses publicly in order to improve transparency and integrity of the allowance system.23

The Inspectorate examined how expenses are being reported in council annual reports to ascertain compliance with regulation 14(2)(db) of the 2014 Regulations. Regulation 14(2) (db) requires councils to annually report details of expenses, including reimbursement of expenses, paid by the council for each councillor. The expenses are to be categorised separately as travel expenses, car mileage expenses, childcare expenses, information and communication technology expenses, and conference and training expenses.

The Inspectorate also sought to identify whether the five expenses categories in the 2014 Regulations are sufficient or should be amended or expanded; and explored the reporting of councillor expenses on council websites.

23. Section 98(2)(a) and 98(3)(d) of the Local Government Act 2020 and Regulation 14(2)(db) of the Local Government (Planning and Reporting) Regulations 2014

Encouraging expense claims reviews

Expense claims reviews

The seven councils audited by the Inspectorate varied in whether they provide expense data to their councillors for review or not. To improve transparency and follow best practice in the assessing and processing of expenses claims, councils should regularly provide their councillors with expenses information for review. This allows any anomalies to be identified and encourages councillors to be more cognisant of their expenses.

The Act now requires councils to provide details of all councillor expenses reimbursements made under section 40 to the Audit and Risk Committee.27 In its draft Council Expenses Policy, LGV suggested that a quarterly report be provided to council and council’s Audit and Risk Committee, which includes:

- expenses incurred by councillors during the quarter;

- reimbursement claims made by councillors during the quarter; and

- reimbursements made by councillors during the quarter.28

If councils do this on a quarterly basis, it would provide a simpler mechanism for independent review and monitoring of expenses.

Recommendations

- LGV should provide guidance to councils on the definitions of the five expenses categories in the 2014 Regulations and how to report on expenses that do not fall within these categories.

- Councils should provide councillors with their expenses data for review on a quarterly basis.

- Councils should report councillor expenses and reimbursement claims to council and council’s Audit & Risk Committee on a quarterly basis.

- Councils should publish councillor expenses data on their websites on a quarterly basis, at a minimum.

27. Section 40(2) of the Local Government Act 2020

28. LGV engagement with the sector on council expenses policy

Council expenses policy

A comprehensive expenses policy is one of the pillars of good governance for a council. It should balance the need for rigorous process, value for money and efficiency in decision making to ensure councils continue to function in accordance with community expectations. In order to address these requirements, the policy should be reviewed at least once in each financial year.

Council expenses policies and procedures need to provide transparency and accountability of councillor expenses and help mitigate corruption risks. Council policies that promote these outcomes clearly specify:

- what types of councillor expenses council will reimburse. This must include at a minimum the categories of expenses identified in the 2014 Regulations and in the Act,29 together with any other types of expenses a council considers are reasonably incurred while carrying out the duties of councillor

- what form is to be used to make a claim for reimbursement and what information is required to be included in a claim form in support of the claim. Council business should be clearly defined and the purpose of the expense and how it relates to the duties of a councillor should be included

- what documentary evidence is required in addition to the claim form. For example, a GST tax invoice, receipts, logbook entries or a report regarding training attended

- council personnel involved in the claims process and what each of their roles and responsibilities are, such as who is responsible for completing the claim form and providing supporting evidence, checking the legitimacy of the claim, authorising the expense, and processing the reimbursement

- the date for lodgement of reimbursement claims, for example, within one month of incurring the expense or by a certain day of each month;

- how reimbursements will be provided to councillors, such as on a monthly basis by electronic funds transfer

Early in 2020, Local Government Victoria sought feedback on council expenses policies and working with councils on best practice for a policy.30 In June 2020, LGV published a draft Council Expenses Policy, with the aim of refining this draft policy as further feedback was received from councils.

The draft policy aims to apply sections 40 and 41 of the Act in a policy framework by setting out:

- criteria for the reimbursement of out-of-pocket expenses

- requirement to reimburse carer and dependent- related expenses

- requirement to provide the details of expenses reimbursements to council’s Audit and Risk Committee; and

- procedures to be followed in applying for and making reimbursements of expenses

While the draft policy specifies that childcare and carer’s expenses are qualifying expenses as required under the Act it mainly provides broad advice on reimbursement procedures and requires councils to apply their own judgment on what should be included in their policy.

Based on feedback received by the Inspectorate through its surveys and discussions with council governance staff, councils want guidance on the content of their expenses policies, including:

- what kinds of expenses are and are not reimbursable, with questions such as whether councillor produced ward newsletters, or buying alcohol or meals for other persons should qualify for reimbursement

- whether caps should apply to certain categories of expenses, such as attendance at conferences and training

- whether there should be a time limit on the submission of claims for reimbursement; and

- who should approve expense reimbursement claims

The Inspectorate’s review of council expenses policies showed variation in matters including the extent of entitlements, based on differences in the rates of reimbursement (e.g. for kilometres travelled) and whether caps are in place for certain types of expenditure, and if they are, the amount of them. The biggest variation exists in relation to professional development and training caps, while other councils have caps for items such as meals and childcare rates.

A ‘better practice’ template policy for councillor expenses and facilities was developed by the NSW Office of Local Government in 2017.31 The template policy addresses areas similar to those in which council governance staff are seeking further guidance. For example, the template policy suggests councils devise caps for certain categories of expenses, specifies what types of memberships of professional bodies will be reimbursed, and states that councillors will not be reimbursed for alcoholic beverages. Victorian councils would be assisted by a similarly detailed model template for an expenses policy, which can be modified to meet their individual needs.

In addition, an accompanying model claim form and expense reimbursement procedure document would greatly assist councils. The use of such documents would encourage standardisation of entitlements across councils and quell uncertainty within councils regarding the content of their policies.

Section 41(2) of the Act requires the Council Expenses Policy to specify the expenses reimbursement procedures and LGV’s draft policy provides an example of what these procedures may look like. The 7 audited councils largely did not capture relevant procedures, such as how claims are processed and who is involved in the process, in their policies or in a stand-alone document. Instead, they relied upon staff to share knowledge regarding how things are done.

While there is no requirement for a standalone procedural document, it would be best practice for councils to have such a document. Strathbogie Shire Council developed an expense reimbursement procedure document to accompany their councillor expenses policy, which they amended following a review by the Victorian Auditor-General’s Office in 2018-19. According to council governance staff, this procedural document has improved compliance with and understanding of the expenses policy.

29. Sections 41(2)(c), (d) of the Local Government Act 2020

30. See the Local Government Victoria engage site for more information

31. Policy and guidelines available on the OLG website

Council expense reimbursement claim audit – issues and risk ratings

For each of the 7 councils, the Inspectorate audited a sample of expense reimbursement claims for compliance with the council’s expenses policy and discussed relevant matters with council representatives.

As part of the audit exercise, the following matters were considered:

1. Councillor expenses reimbursement claim forms.

2. Councillor expenses policy.

3. Councillor expenses procedure.

4. Oversight of councillor expenses, including audits.

During the audit exercise, various risks were identified, which ranged in severity from issues that could lead to fraudulent activity or the wrong amount being reimbursed (both very high risk) to claims being submitted outside of the required time period (lower risk) (see Figure 12).

While these specific issues have been pursued with the relevant council and rectified where possible, they are shown here as examples of common issues seen across councillor expense reimbursement audits.

| Council | Classification | Planning region |

|---|---|---|

| Hepburn | Small shire | Central Highlands |

| Strathbogie | Small shire | Hume |

| Campaspe | Large shire | Loddon Mallee North |

| MItchell | Large shire | Hume |

| Yarra | Metro | Greater Melbourne |

| Hobsons Bay | Metro | Greater Melbourne |

| Bendigo | Regional | Loddon Campaspe |

What are the key issues or challenges?

Councillor expenses policies and procedures vary greatly across councils.

There is no uniform level of evidence required to support claims for reimbursement.

Council oversight of expenses, including checks on legitimacy and sign-off on claims, is also varied and is a potential financial or integrity risk.

| Issues found in council audits | Risk rating32 |

|---|---|

| Claims submitted outside of the required time period |

Low |

| Inconsistent application of the practice of rounding of kilometres travelled to the nearest whole number for private vehicle use |

Low |

| No evidence required in support of private vehicle use kilometres travelled |

Moderate |

| Descriptions of the expenses incurred lack detail | Moderate |

| Administrative error in failing to accurately document the basis of calculating a reimbursement |

Moderate |

| Claims for car mileage expenses for council meeting attendance do not include the locations of the meetings attended |

Moderate |

| Policy refers to an outdated claim form | Moderate |

| Claims not applied for in writing but petty cash form used instead |

High |

| Claims not clear on how the expenses were incurred while performing duties as a councillor |

High |

| Claim forms include space for signature of authorising officer, but do not include space for their name or position |

High |

| CEO’s corporate credit card used for purchases by the Mayor |

Very high |

| Incorrect rate for kilometre reimbursement for private vehicle use applied |

Very high |

Best practices observed in the course of the audit, which may assist in reducing the risks of inappropriate or fraudulent expenses claims, include:

- expense claims are authorised by more than one senior council employee with the appropriate financial delegation, thereby providing additional oversight

- instead of using phrases like ‘reasonable costs’ or ‘appropriate costs’ will be reimbursed, monetary ranges or caps for food/beverage and accommodation costs are specified

- claims for private vehicle use are required to be supported by logbook entries or records of odometer readings at the start and end of the journey, rather than just a single figure for kilometres travelled

- councillors are required to submit a written report following attendance at training and professional development courses in order to justify their attendance and to share their learnings with council

- councillors are not permitted to cover the costs of meals or refreshments for anyone other than themselves, where these items relate to the duties of councillor.

Recommendations

- LGV should consider a more detailed model councillor expenses policy and claim form, which councils can adopt to suit their individual circumstances.

- Councils must publish their current Council Expenses Policy on their website.

- Councils must train councillors on the Council Expenses Policy during their induction training and provide refresher training on the policy mid-term.

- Councillor expenses must be authorised by council employees with the appropriate financial delegation, not the mayor.

32. Risk ratings determined by Inspectorate risk criteria

Case studies

Information and Communications Technology

Information and Communications Technology (ICT) is a key area in which value for money can be achieved. The Inspectorate recommends Councils regularly review their phone and data plans and seek out better value plans and more cost-effective technology solutions. ICT is also a key area in which councillor needs can be better met by monitoring use to ensure current plans are tailored towards usage needs.

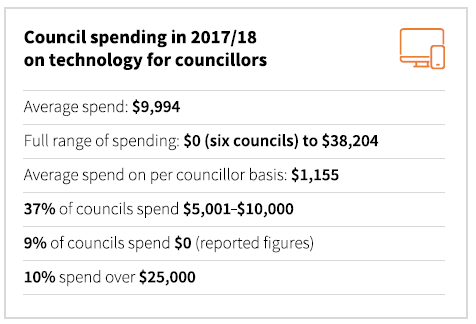

The councillor ICT expenses for the 2017/18 financial year reported to the Inspectorate showed great variation in the amount spent by councils on ICT for councillors. While councils most commonly spent between $5,000 and $10,000 on ICT for councillors annually (37% of surveyed councils), 10% reported spending upwards of $25,000. Table 1 shows spending on ICT for councillors across council groupings.

The difference in spend can be attributed to the variation between councils in relation to ICT hardware provided to their councillors (usually based on individual preference of councillors) and what ICT plans they use (usually based on location i.e. because of reception, and usage habits).

For example, in response to the survey, one regional council reported that given they do not have full network coverage across their municipality, staff work individually with councillors to best meet their phone and data requirements for their local area. Several councils reported they provide broadband access only for one or two councillors where reception is poor, while another council meets the landline costs for one councillor in a mobile blackspot.

| Council classification |

Councillor ICT expenses |

Total councillor expenses |

ICT as % of total councillor expenses |

ICT expenses on a per councillor basis per year |

|---|---|---|---|---|

| Large Shire | $130,953 | $1,019,982 | 13% | $897 |

| Metropolitan | $317,175 | $1,056,553 | 30% | $1,570 |

| Regional | $68,695 | $346,460 | 20% | $1,073 |

| Small Shire | $61,667 | $407,125 | 15% | $611 |

| Interface | $144,926 | $693,591 | 21% | $1,628 |

A further explanation of the difference in councillor ICT spend is the variation in council reporting of expenses is covered in section 5.2 of this report. For example, some councils included councillor ICT expenses in their council ICT budget, instead of apportioning it as a councillor expense.

Recommendations

- Councils should regularly review their councillors’ mobile phone and data plans and investigate alternatives, in order to achieve cost savings.

- Councils should engage with MAV procurement for guidance regarding their ICT contracts and should explore the possibility of moving to a TPAMS contract to see if it will achieve costs savings.

- Councils should regularly review their councillors’ phone and data usage to ensure the adequacy of the plans.

- For councillors who have elected to use their own handsets and seek reimbursement, councils should regularly monitor usage to prevent inappropriate reimbursement for private use.

Case study

Conclusion

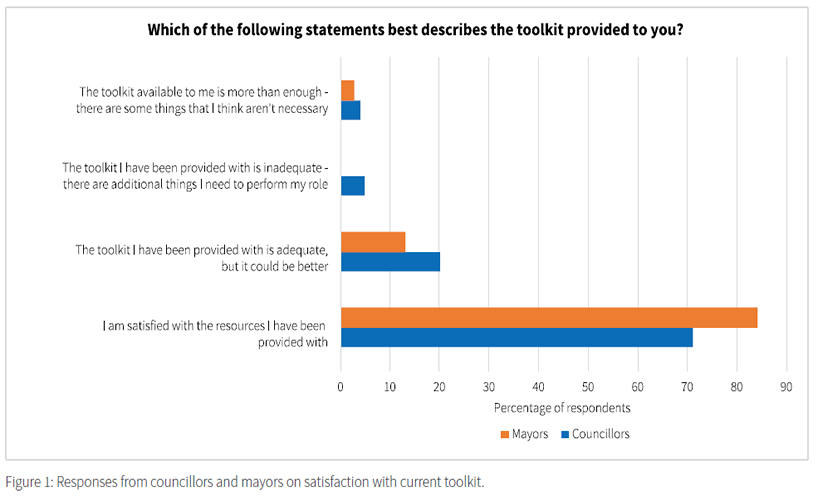

The Inspectorate’s surveys showed councillors are generally satisfied with the resources and facilities provided to them. Despite this, councils would benefit from receiving current guidance on what they should reasonably be expected to provide to councillors.

The review of annual reports and discussions with councils revealed councils are categorising expenses in different ways. This is due largely to an absence of definitions of the five expenses categories in the Act or 2014 Regulations. Councils need guidance on what the categories mean and how to deal with expenses falling outside of these categories. This would improve consistency in reporting and aid comparison of councillor expenses across councils, thereby increasing transparency.

Aside from standard disclosures in their annual reports, councils are generally not making expenses information publicly available on a regular basis. Greater transparency would be achieved by implementing a sector wide practice of regular public expense reporting via council websites.

Appendices

In July 2019, council governance staff at all 79 councils were sent a survey requesting information on the level of support provided to councillors for items such as information technology, travel costs, training and childcare (Appendix 1).

This included providing expenses data for the 2017/18 financial year, confirming the types of resources provided to councillors such as vehicles and office space, and providing data on technology including mobile phone plans. The Inspectorate received responses from governance staff at 76 councils.

The following month, all mayors and councillors were sent a survey seeking their opinions on matters of councillor allowances, resources and facilities, and expense reimbursement (Appendix 2). Responses were received from 187 councillors and 39 mayors, representing nearly 40% of those contacted.